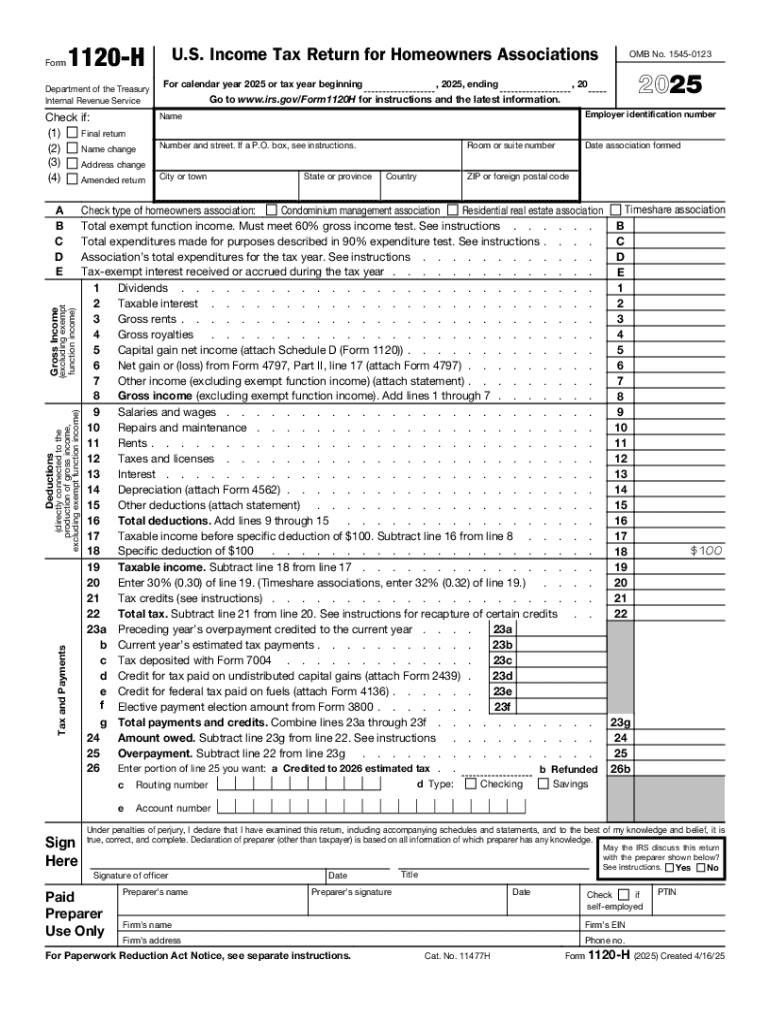

IRS 1120-H 2025-2026 free printable template

Instructions and Help about IRS 1120-H

How to edit IRS 1120-H

How to fill out IRS 1120-H

Latest updates to IRS 1120-H

All You Need to Know About IRS 1120-H

What is IRS 1120-H?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1120-H

What should I do if I discover an error after filing IRS 1120-H?

If you discover an error on your filed IRS 1120-H, you can submit an amended return using Form 1120-H. Ensure that you clearly indicate the changes made and the reason for the amendment. Keep documentation supporting the correction for your records, as the IRS may request it.

How can I check the status of my IRS 1120-H submission?

To check the status of your IRS 1120-H submission, you can use the IRS's online tools or contact their helpline. Look for e-file acknowledgment emails or documentation that confirms receipt of your return. If you face issues, ensure you have your submission details handy for quicker assistance.

What are common errors to avoid when filing IRS 1120-H?

Common errors when filing IRS 1120-H include incorrect taxpayer identification numbers, miscalculations in income or deductions, and failing to sign the return electronically. Double-checking figures and ensuring the application is completed thoroughly can help prevent these issues.

Are e-signatures accepted for IRS 1120-H filings?

Yes, e-signatures are accepted for IRS 1120-H filings. However, it is crucial to follow the IRS guidelines to ensure that your e-signature meets the required standards. This helps in confirming the identity of the signer and the authenticity of the submission.

What should I do if I receive a notice regarding my IRS 1120-H filing?

If you receive a notice related to your IRS 1120-H filing, review the document carefully to understand the issue. Prepare any required documentation and respond promptly to the IRS, addressing the concerns raised in the notice. You may need to consult a tax professional for guidance on how to proceed.

See what our users say